By Dan Boudreau

Are you heading out trick-or-treating for a business loan? No matter how bewitching your costume, the following deal breakers will block your success and leave you with an empty pillowcase.

1. Ghostly Equity. If you’re hoping to get your deal off the ground with 100% financing, you’ll probably creep out potential lenders. Zero owner equity might make great fodder for sinister spam attacks, but it will usually break a small business start-up deal. Unless you’ve put the love-money hex on your Mom or Aunt Elvira, your no-equity plan will scare the cape off investors. To avoid having your business idea burned at the stake, plan to treat your banker to at least 20% equity.

2. Card & Toy Goblins. Is your yard haunted by trucks, boats, and skidoos? There is nothing wrong with toys if you can afford them; the deal breakers arise from the high interest loans, the bursting, bug-eyed credit cards, and the slimy go-nowhere minimum payments. It’s easy to be tricked into the “cards & toys” trap while you’re earning gobs of money. This spooky deal breaker usually pops up after an unplanned reduction of income, such as an illness or injury, or losing your job. If exorbitant interest rates are goblin’ up your profits, you might want to carve up the credit cards and sell a couple toys before letting investors have a boo at your business plan.

3. Eerie Forecasts. If your financial projections are silhouetted against images of fireworks and a cow jumping over the moon, your business proposal is likely headed for an early grave. When it comes to borrowing money, pie-in-the-sky forecasts will not get your new venture off the ground. The cashflow is your opportunity to convince the lender that you know your stuff. Common sense and genuine curiosity are the only tricks you need to forecast convincing financial projections.

4. Spooky Liabilities. Are there trolls lurking in the shadows of your business deal? Lingering lawsuits and unresolved marital disputes spell risk for potential investors. Aging accounts payable and unpaid taxes signal trouble too. In order to secure a loan or investment to start your business, you will need to have a credible strategy for looming threats and a viable plan to pay all debts and dispel any lingering doubt about your capabilities.

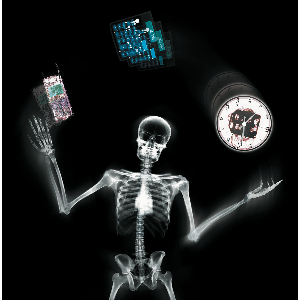

5. Credit Skeletons. A creepy credit rating will drive a stake through the heart of your loan application. In today’s overleveraged consumer frenzy, it’s easy to end up with a financial black eye. Is your credit coffin alive with the shrieking and moaning of befanged collections werewolves lusting after your blood in lieu of long overdue interest on unpaid bills, or worse – one of those ghastly, eternally binding student loans? When it comes to nailing down funds to get your business idea off the ground, the rattling of sabers and financial bones are sure to creep out interested bankers.

The best time to tidy up deal breakers is before you head out searching for a loan. Your business proposal will be stronger if you first purge your financial closet of any surprises that might make your lender owly.