With the ever changing demands of the new economy many individuals are opting to direct and control their careers through self-employment.

With the ever changing demands of the new economy many individuals are opting to direct and control their careers through self-employment.

There are several benefits to being self-employed. You will:

▪ Have more freedom.

▪ Have more control over your work schedule.

▪ Have the choice to work from home.

▪ Be paid more money for the work.

▪ Be able to take on work from different sources.

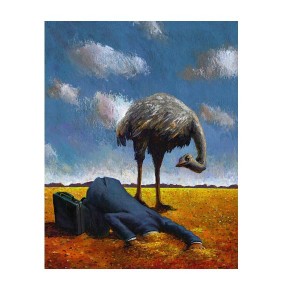

Making the transition from employee to running your own business can be overwhelming. As the business owner or self-employed contractor, you will need to figure out how much to charge for your services, learn to ride or avoid the feast or famine trap, be responsible for 100% of the finances (both personal and business), find a balance between paid and unpaid tasks, stay on top of small business legal and regulatory requirements, and get paid last. Yes, your financial advisor is right about paying yourself first – however, that advice is for people who get pay cheques. When you’re self-employed, your own cheque will be the last one you write; after all other expenses have been paid. The silver lining in this is that, if you work hard and do things right, your pay cheques should be more than when working for someone else. And that is just one of the joys of being self-employed. If you’re prepared to reach out for what you want, the world of business is a playground awaiting your participation.

If you dream of working for yourself, mark your calendar for June 2012. The upcoming Fast-Track to Self-Employment BootCamp will provide you the opportunity to make your dream a reality.

This workshop will help you make the transition from employee to self-employed business owner safely and with confidence. The workshop will cover such topics as market research, understanding industries, identifying opportunities in learner-specific fields of interest, developing and describing a business concept, marketing for self-employed, navigating legal and regulatory requirements, assessing the competition, knowing what customers want, bookkeeping, accounting, taxation, social network marketing, business communications, and understanding labour markets.

Participants will leave the workshop with a basic understanding of what it means to own and operate a small business in the 21st century, how to start a small business, and how to get contracts and keep busy as an independent, self-employed contractor.

Fast-Track to Self-Employment BootCamp

Upcoming Workshop Dates and Locations

| City | Location | Workshop Dates | Instructor |

| Prince George, BC | Sprott-Shaw Campus 1575 2nd Ave |

June 5, 6, 7, 2012 | Dan Boudreau |

| Kelowna, BC | Sprott-Shaw Campus #200-546 Leon Ave. |

June 11, 12, 13, 2012 | Dan Boudreau |

| Victoria, BC | Sprott-Shaw Campus 2621 Douglas St. |

June 20, 21, 22, 2012 | Dan Boudreau |

| Vancouver, BC | Sprott-Shaw Campus 2750 Rupert Street |

June 25, 26, 27, 2012 | Dan Boudreau |

This workshop includes:

This workshop includes:

- 18 hours of in-class time

- 37 hours of individual guided research, business planning and set-up time,

- 4 – 1 Hour Teleseminars

After attending the workshops and starting your through your individual guided research you will have an opportunity to ask questions and discuss successes, speedbumps and any other issues you have encountered.

Teleseminar 1: July 3 at 10:00pm PST

Teleseminar 2: July 24 at 10:00pm PST

Teleseminar 3: August 07 at 10:00pm PST

Teleseminar 4: August 21 at 10:00pm PST

If for any reason, you are unable to attend any of the 1-hour teleseminars, you will be provided a link to a recording of the phone call so you can listen on your own time.

- 1 hour per participant individual one-on-one business coaching time.

- Unlimited Access to the RiskBuster Business Plan Oasis Membership Website.

For more information visit Fast-Track to Self Employment BootCamp Course Description

Or Contact Workshop Facilitator Dan Boudreau

As a business plan coach and a small business lender, I think I’ve heard all of the objections to business planning—it takes too long, it’s wasting valuable marketing time, it’s difficult, it’s complicated, the opportunity will pass me by if I take time to plan, I know a successful business owner who never wrote a plan, nobody reads business plans anyway, the minute you write a business plan it changes—the list goes on. All of these rationales arise from a lack of understanding about what a business plan is and how it can stack the cards in the entrepreneur’s favour.

As a business plan coach and a small business lender, I think I’ve heard all of the objections to business planning—it takes too long, it’s wasting valuable marketing time, it’s difficult, it’s complicated, the opportunity will pass me by if I take time to plan, I know a successful business owner who never wrote a plan, nobody reads business plans anyway, the minute you write a business plan it changes—the list goes on. All of these rationales arise from a lack of understanding about what a business plan is and how it can stack the cards in the entrepreneur’s favour.